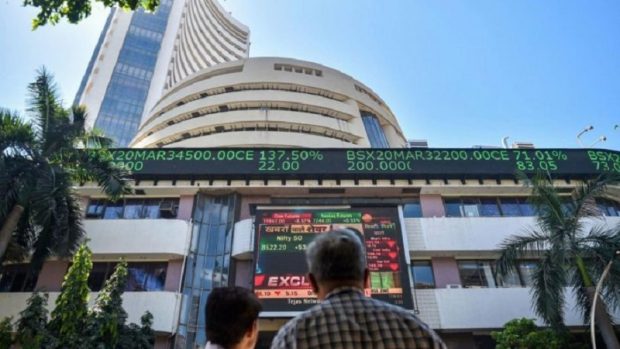

Global factors, foreign fund trading activity to drive markets this week: Analysts

PTI, Dec 18, 2022, 10:16 AM IST

The domestic equity market would focus on global trends and foreign fund trading activity this week amid lack of any major trigger at home, analysts said.

”This week won’t bring any significant cues, so we may see a tussle between bulls and bears. Because the US market is currently experiencing the second wave of selling following the Federal Open Market Committee (FOMC) meeting, its direction will continue to be crucial.

”Due to the fact that FIIs were net sellers for a significant portion of December, institutional flows will be another crucial trigger,” said Santosh Meena, Head of Research, Swastika Investmart Ltd.

Ajit Mishra, VP – Technical Research, Religare Broking Ltd, said, in absence of any major event, cues from global indices, especially the US, would remain on participants’ radar.

Global central banks like the European Central Bank (ECB) and Bank of England (BoE) followed the US Federal Reserve in increasing policy rates and giving hawkish commentary, sending equities tumbling world-wide last week.

Past week, the Sensex declined 843.86 points or 1.36 per cent, while the Nifty shed 227.60 points or 1.23 per cent.

”The Fed startled the market by maintaining its hawkish tone, as investors were expecting a softer approach after the release of better-than-expected inflation numbers. Following the Fed, BoE and ECB raised their interest rate by 50 bps while maintaining their hawkish stance in combating inflation,” said Vinod Nair, Head of Research at Geojit Financial Services.

Lack of major triggers will push the domestic market to follow its global peers this week, Nair added.

”Markets are likely to remain in consolidative range due to lack of triggers in the near-term. Also, lower participation from institutional investors due to upcoming year-end holidays would keep the markets lackluster. Though investors would keep an eye on US home sales and GDP (QoQ) numbers to be released this week,” Siddhartha Khemka, Head – Retail Research, Motilal Oswal Financial Services Ltd, said.

Udayavani is now on Telegram. Click here to join our channel and stay updated with the latest news.

Top News

Related Articles More

Markets stage sharp recovery; Sensex reclaims 79k level, Nifty surges 557.35 points

Baku climate talks: The ‘X’ factor that could determine future of Global South

Kidnapped for ransom in 1998, 26/11 survivor Gautam Adani faces biggest trial

Gautam Adani charged in US with USD 250 mn bribery, fraud

India’s GDP growth likely to slip at 6.5 pc, maintains 7 pc estimate for FY25: Icra

MUST WATCH

Latest Additions

Public Alert: Cyber fraudsters impersonating traffic police to demand fines

Court acquits MLA Bachchu Kadu in 2011 Mantralaya clerk slapping case

Markets stage sharp recovery; Sensex reclaims 79k level, Nifty surges 557.35 points

UP: 25 people booked for attacking civic officials for encroachment removal

SC transfers cheating case against choreographer Remo D’Souza to Delhi court

Thanks for visiting Udayavani

You seem to have an Ad Blocker on.

To continue reading, please turn it off or whitelist Udayavani.