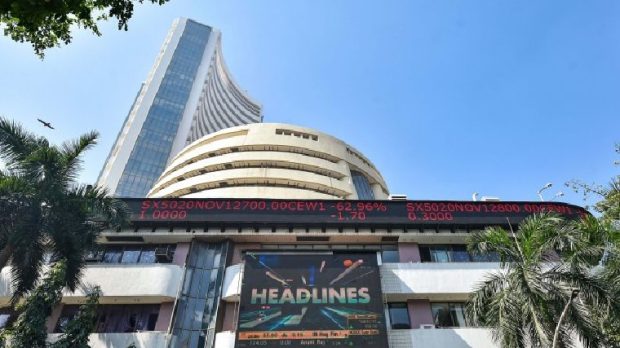

FPIs adopt cautious stance ahead of Budget; take out Rs 17,000 cr from equities in Jan

PTI, Jan 29, 2023, 10:39 AM IST

Foreign investors have pulled out a net of over Rs 17,000 crore this month so far due to the attractiveness of the Chinese markets and the cautious stance adopted by them ahead of the Union Budget and US Federal Reserve meeting.

The outflow in January came after a net inflow of Rs 11,119 crore in December and Rs 36,239 crore in November.

Overall, foreign portfolio investors (FPIs) have pulled out Rs 1.21 lakh crore from the Indian equity markets in 2022, following aggressive rate hikes by the central banks globally, particularly the US Federal Reserve, volatile crude, rising commodity prices and the Russia-Ukraine conflict.

For FPIs, 2022 was a subdued year in terms of flow and withdrawal from equities after a net investment in the preceding three years.

According to the data with the depositories, FPIs have made a net withdrawal of Rs 17,023 crore this month (till January 27).

Himanshu Srivastava, Associate Director – Manager Research, Morningstar India, said that FPIs are adopting a cautious stance, as they are apprehensive ahead of the US Federal Reserve meeting and the Union Budget on February 1. The Fed’s monetary policy committee will meet from January 31 to February 1. Also, FPIs have been focusing on China after its markets reopened after the lockdown. Under its zero COVID policy, China was enforcing rigorous lockdowns to reduce the number of cases. As a result, Chinese markets declined, making them more appealing from a value standpoint, Srivastava said.

This caused FPIs to shift their focus from economies with relatively high valuations like India to China, he added.

Additionally, a weak global economic growth outlook has raised concerns about the US economy entering a recession, Srivastava said.

FPI strategy in January has been selling in India and buying in relatively cheaper markets like China, Hong Kong, South Korea and Thailand, VK Vijayakumar, Chief Investment Strategist at Geojit Financial Services, said.

On the hand, FPIs have invested in debt securities to the tune of Rs 3,685 crore so far this month.

Apart from India, FPI flows were negative for Indonesia also so far this month, while it was positive for the Philippines, South Korea and Thailand.

Going forward, FPI flows are expected to remain volatile in India as market participants remained cautious ahead of the Union Budget next week while the 3Q FY22 earnings season failed to enthuse, Shrikant Chouhan, Head of Equity Research ( Retail), Kotak Securities Ltd, said.

Udayavani is now on Telegram. Click here to join our channel and stay updated with the latest news.

Top News

Related Articles More

Baku climate talks: The ‘X’ factor that could determine future of Global South

Kidnapped for ransom in 1998, 26/11 survivor Gautam Adani faces biggest trial

Gautam Adani charged in US with USD 250 mn bribery, fraud

India’s GDP growth likely to slip at 6.5 pc, maintains 7 pc estimate for FY25: Icra

RBI cautions public about ‘deepfake’ video of governor being circulated on social media

MUST WATCH

Latest Additions

SC notice to Gujarat govt on Asaram’s plea seeking suspension of sentence in 2013 rape case

BJP stages protest against Karnataka govt over Waqf properties row

US charges against Adani, 7 others could lead to arrest warrants, extradition bid: attorney

Youth attempts suicide after being humiliated in public for wearing ripped jeans in Belthangady

Baku climate talks: The ‘X’ factor that could determine future of Global South

Thanks for visiting Udayavani

You seem to have an Ad Blocker on.

To continue reading, please turn it off or whitelist Udayavani.