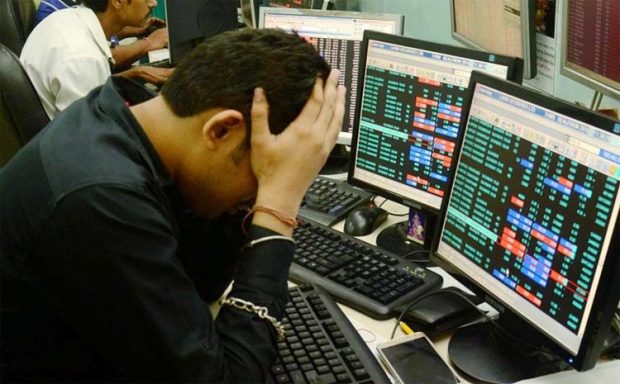

Sensex sinks 561 points as global markets crash

Team Udayavani, Feb 7, 2018, 9:42 AM IST

Mumbai: Equities nursed losses for the sixth straight session on Tuesday, as the post-Budget sell-off continued amid a meltdown in the world markets. Investors saw a wealth erosion of more than Rs 2.72 lakh crore after the BSE Sensex plunged by 561 points to close at a one-month low of 34,195.94. The broader Nifty too shed 168.30 points to finish at 10,498.25.

Global markets nosedived on Tuesday after a record-breaking loss on Wall Street, extending a global rout as investors fret over rising US borrowing costs. The Dow on Monday suffered its worst points fall in history and wiped out all its 2018 gains, while the S&P 500 also took a beating.

Domestic participants were also anxious ahead of the RBI policy meet outcome amid indications that the central bank will keep rates on hold in view of firming inflation. The start was distinctly weak as the Sensex crashed by about 1,275 points to sink below the key 34,000-mark, while the NSE Nifty plunged 390 points within minutes of opening.

However, value-buying emerged at several counters during the late afternoon session. The Sensex finally ended at 34,195.94, down 561.22 points, or 1.61%. This is its weakest closing since January 5 when the gauge had settled at 34,153.85.

The 50-share NSE Nifty too closed down 168.30 points, or 1.58%, at 10,498.25 – a level last seen on January 3, when it closed at 10,443.20. Intra-day, it touched a low of 10,276.30, and a high of 10,594.15. The Sensex has now lost 1,769.08 points since the Budget on February 1, which imposed a long-term capital gains tax on equities and projected a wider fiscal deficit than earlier targeted.

According to provisional data, foreign portfolio investors (FPIs), who had been making persistent purchases, net sold shares worth Rs 1,263.57 crore, while domestic institutional investors (DIIs) bought shares worth a net Rs 1,163.64 crore on Monday. In the Sensex pack, Tata Motors emerged as the worst performer by crashing 5.45%, followed by TCS at 3.58%.

Sector-wise, the BSE IT index fell the most at 2.80%. Consumer durables, tech, realty, healthcare, FMCG, PSU, auto, metal, power, oil & gas, bankex and infrastructure stocks also kept low. Overseas, most Asian indices ended lower. Japan’s Nikkei fell 4.73%, Hong Kong’s Hang Seng lost 5.12%, while Shanghai Composite Index shed 3.35%.

European shares too were in bad shape in their opening deals. Frankfurt’s DAX fell 1.97% and Paris CAC lost 1.75%. London’s FTSE too fell 1.73%.

Udayavani is now on Telegram. Click here to join our channel and stay updated with the latest news.

Top News

Related Articles More

Sony India bags ACC media rights for eight years

Musk says X now top news app on App Store in India

Air India to offer integrated aircraft maintenance engineering programme

Markets stage sharp recovery; Sensex reclaims 79k level, Nifty surges 557.35 points

Baku climate talks: The ‘X’ factor that could determine future of Global South

MUST WATCH

Latest Additions

Air pollution: SC flags Delhi govt’s failure to implement GRAP-4 curbs on entry of trucks

Drugs worth Rs 6 crore seized in Bengaluru, five arrested

Siddaramaiah urges Nirmala Sitharaman to address NABARD’s loan cuts to farmers

Satwik-Chirag enter semifinals, Lakshya loses to Antonsen in China Masters

BJP stages protest against Congress govt in Karnataka over Waqf properties row

Thanks for visiting Udayavani

You seem to have an Ad Blocker on.

To continue reading, please turn it off or whitelist Udayavani.