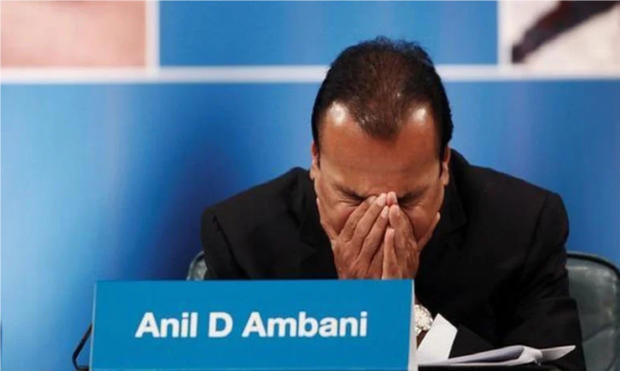

Riches to Rags: The downfall of Anil Ambani’s Empire

Team Udayavani, Jun 12, 2020, 1:26 PM IST

Anil Ambani was ordered by a UK court on February 7 to pay an amount of 100 million dollars within six weeks to the three Chinese banks as a part of the recovery of 680 million dollars.

The lawsuit was filed by the three Chinese banks, which argued that they had provided a loan of $925 million to RCom in 2012, on condition that he personally guarantee the debt.

Anil Ambani pleaded, “The value of my investments has collapsed. I do not hold any worthy assets which can be liquidated for the purpose of these proceedings. The current value of my holding is down to 82.4 million dollars and my new worth is zero after taking into account my liabilities”

However, Judge David Waksman has set a six-week timeline for such a payment as he concluded that he did not accept Ambani’s defence that his net worth was nearly zero, or that his family would not step in to assist him

This similar incident happened in 2019, Anil Ambani was held up by the Supreme Court in another legal battle in which threatened to send him to prison if he did not pay up Rs 550 crore to the Indian unit of Ericsson. Anil was given a month’s time and fortunately Mukesh Ambani stepped in and paid the amount on Anil’s behalf

Anil Ambani is the younger brother of richest businessman of India Mukesh Ambani and son of Dhirubai Ambani. Anil Ambani was counted as India’s richest person but now his net worth is zero

Dhirubhai Ambani was legendary for his audacious vision. At the age of 17, he migrated to the British colony of Aden to join his brother and started his career as a clerk at A. Besse & Co where he learned trading, accounting, and other business skills. In 1958 Ambani returned to India and settled in Bombay

Ambani began a business trading in spices in the late 1950s, calling his nascent venture Reliance Commercial Corporation. In 1977 Ambani took Reliance public after nationalized banks refused to finance him.

In the mid-1980s, Ambani handed over the day-to-day running of the company to his sons, Mukesh Ambani and Anil Ambani

In 2002, Anil Ambani’s father Dhirubhai Ambani passed away and did not leave a will despite disputes between the two.

Mukesh was the one who understood the petroleum company and he was the one who built the Patalganga plant. Reliance communications was also Mukesh’s brain child but Anil wanted it.

In 2004-05, Kokilaben, Dhirubai Ambani’s wife and their mother stepped into divide the conglomerate along with CA S Gurumurthy and Banker K V Kamath.

Mukesh got all the old economy companies, Reliance industries, Petroleum, IPCL, Infrastructure while Anil got all the new economy companies RCOM, Reliance capital, energy, natural resources and broadcasting.

There were speculations that Anil Ambani would do much better than his brother Mukesh Ambani but he was still below his brother in terms of net worth.

In 2005, Anil brought Adlab films and their chain of theatres Big Cinemas which by 2008 had become the largest multiplex chain with 700 theatres across India and overseas.

Anil then became a very popular figure in the industry and was also known as a very successful businessman.

But, things however did not go as planned, relation between the two brother soured due to a dispute related to the Supply of gas which lead to a court case against each other.

Under the 2005 contract, Mukesh’s RIL had contracted to supply gas to RNRL at $2.34/MMBtu even though the its price had since risen sharply in international markets. But, Supreme Court in accordance to the gas utilisation policy fixed the price at $4.24/MMBtu in favour of Mukesh’s RIL

Even in telecom industry, Anil Ambani faced a hit as when RCOM was set up they used CDMA while the rivals used the more expensive GSM.

Also, once the 10 year Anti-competition clause with his brother lapsed in 2015, Mukesh Ambani launched JIO and changed the face of telecom industry in India.

Just within 3 year’s of Jio’s launch RCOM’s market capitalisation lost over 98 percent of value and went into insolvency proceeding in May 2018.

In an effort to avoid debt, in 2014, Anil sold Big Cinemas to carnival for Rs 710 Cr and 2 year later he sold parts of TV and FM radio to Zee network.

He also took huge loans to build Mumbai’s sea link and Versova Ghatkopar metro which were done below cost.

Anil also tried his hand in defense sector without domain knowledge and brought Pipavav Marine and offshore engineering but the market capital of pipavav fell 90 percent in 2019.

Reliance Energy was also sold off to Adani in 2017-18 to pay off debts.

In order to reach the same heights as his brother, Anil Ambani began borrowing large sums of money to grow his business

Also, loans that Anil Ambani defaulted on worth Rs 12, 800 Cr also played a part in the downfall of Yes Bank

While Mukesh Ambani’s wealth remained steady at $43 bn in 2019, Anil Ambani’s stumbled to $1.7bn.

Well, experts say that Anil Ambani made several mistakes which resulted in his downfall, it is said that Anil lacks the patience and endurance that running a business requires and used to take all the decision by himself without consulting others. However, the biggest reason for Anil’s downfall has been his excessive dependence on debt

Udayavani is now on Telegram. Click here to join our channel and stay updated with the latest news.

Top News

Related Articles More

Key to past: Indore man collects 570 typewriters from across the world

Kambala: Tradition and modernity in coastal Karnataka

Dairy farmers in K’taka border areas selling milk to Kerala for higher price!

Kadaba: ‘Notion that only English-medium education leads to success is misleading’

Udupi: ‘Team Taulava’ takes charge to preserve endangered ancient monuments

MUST WATCH

Latest Additions

Drugs worth Rs 6 crore seized in Bengaluru, five arrested

Siddaramaiah urges Nirmala Sitharaman to address NABARD’s loan cuts to farmers

Satwik-Chirag enter semifinals, Lakshya loses to Antonsen in China Masters

BJP stages protest against Congress govt in Karnataka over Waqf properties row

Loyalty Remembered: Mangaluru Airport’s K9 hero Jack passes away

Thanks for visiting Udayavani

You seem to have an Ad Blocker on.

To continue reading, please turn it off or whitelist Udayavani.