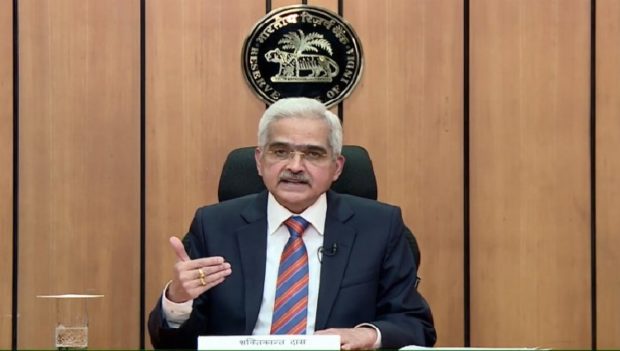

Allowing corporates to start banks is internal panel’s suggestion not RBI’s view, says Das

PTI, Dec 4, 2020, 5:25 PM IST

Mumbai: Allowing corporates to promote banks is not the RBI’s view, and the central bank will take a decision on it and other suggestions made by an internal panel recently only after perusing public comments, Governor Shaktikanta Das said on Friday.

It can be noted that RBI’s Internal Working Group’s (IWG) suggestion to allow corporates into banking has received sharp criticism from experts, including former RBI governors, deputy governors and also chief economic advisors, who fear doing so may put depositors” money at risk as lending can happen to entities within a group.

The IWG has also suggested allowing NBFCs with over Rs 50,000 crore in assets to be considered for conversion into a bank and also lowering the time taken before a payments bank can convert into a small finance bank. These proposals have also received some criticism.

Without going into the specifics, Das said, “It is a report by an IWG of RBI. It should not be seen as RBI’s point of view or decision. That has to be very clearly understood.”

He said the five-member IWG, which had two members of RBI’s central board and three officials from RBI, acted “independently” after deliberations and gave a certain point of view.

“RBI has not taken any decision on these issues so far,” Das said, adding that the central bank will peruse the stakeholders’ and public comments before arriving at a “considered decision.”

It can be noted that as per the report, only one member of the panel supported allowing large corporate or industrial houses to promote banks.

Those in support of the move say allowing the deep-pocketed corporations will make capital available, which will fuel the growth in the economy, especially at a time when the state’s capacity to fund is limited because of fiscal constraints.

In a critique, former RBI Governor Raghuram Rajan and former deputy governor Viral Acharya had said “highly indebted and politically connected business houses” will have the greatest incentive and ability to push for new banking licenses, a move that could make India more likely to succumb to “authoritarian cronyism.”

Udayavani is now on Telegram. Click here to join our channel and stay updated with the latest news.

Top News

Related Articles More

“FM ji FM ji, itna tax main kaise bharun”, asks investor Vijay Kedia in viral post

RBI: After another status quo year, all eyes on a growth-propping rate cut with new Guv at helm

Front-running case: Sebi bans 9 entities from market , impounds illegal gains of over Rs 21 crore

Global trends, FIIs’ move to dictate trends in markets in holiday-shortened week: Analysts

GST Council postpones decision to cut tax on insurance, rate panel defers report submission

MUST WATCH

Latest Additions

“FM ji FM ji, itna tax main kaise bharun”, asks investor Vijay Kedia in viral post

Jyotirmath Shankaracharya slams RSS chief for ‘politically convenient’ position on restoring temples

Geethartha Chinthane 133: Detachment with Responsibility

Passengers on board Air India flight exchange blows over armrest space

PM Modi pays tributes to Charan Singh

Thanks for visiting Udayavani

You seem to have an Ad Blocker on.

To continue reading, please turn it off or whitelist Udayavani.