EMV chip compulsory for ATM cards

Team Udayavani, Dec 10, 2018, 4:03 PM IST

- Last date for change, Dec 31st post which, old cards invalid

Sullia: Customers who are currently in possession and using the old ATM debit cards with magnetic strips must approach their banks at their earliest and get their old ATM cards replaced for the new ATM cards equipped with chips. As per the RBI’s order, come Dec 31st, it will be not possible to draw money using the old cards.

The banks have already started sending messages to their customers regarding this change. In the backdrop of some users facing problem while using their ATM cards, they visited their banks to inquire about the issue and found out about the new development.

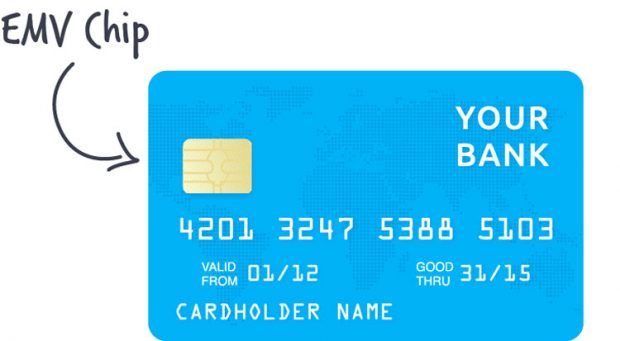

EMV Chip

This chip is in the size of a SIM and is present in the ATM cards which have been issued since recently. This change has been brought since the ATM card incorporated with the chip is considered to be more secure than the ones with the magnetic strip. In the backdrop of the increase in the menace of people being cheated off of their money through online means, the RBI sent a notice to all the banks to issue debit cards in this format. Lately, the banks have been issuing debit cards installed with the EMV chips. A period of a month has been provided for changing the old ATM cards for the new more secure ones.

Old ATM Card

In the old ATM’s with magnetic strip, it was possible to steal the encrypted data in it. If in case the customer lost his card or it was stolen, it was possible to remove the money from the account. The new chip enabled ATM cards will protect the customers from all sorts of cheating; also the chips have the ability to prevent any theft by online thieves by installing skimming tools.

Go straight to the bank

The customers need to go directly to their banks and put an application for the new EMV chip enabled ATM cards. There is no fee for this service. There will be a special code to examine the transactions done by using the EMV chip enabled ATM cards for transactions. This verifies the user, inform sources from the bank.

Along with this, cheque without CTS (Cheque Transaction System) will lose their importance in the coming days. The State Bank of India will stop the use of cheques without CTS from Dec 11th itself, and the remaining banks will make CTS enabled cheques compulsory from Jan 1st.

“On receiving a message asking to get an EMV chip enabled ATM card, the customers’ needs to contact the bank in which their account exists. There the process for availing the new card will take place. Already, several people have collected their new more secure ATM cards,” said Ravindra Kumar, SBI Branch Officer, B C Road.

“I had visited the ATM to withdraw money. I received a message stating my card was dead. Immediately I visited the bank and inquired. That is when I got the information that the old ATM cards need to be changed with the new EMV chip enabled cards,” informs Santhosh, an ATM user, Sullia.

Article by Kiran Prasad Kundadka translated into English by Aaron Dmello

Udayavani is now on Telegram. Click here to join our channel and stay updated with the latest news.

Top News

Related Articles More

Assembly clears Mysuru Development Authority Bill

Boy critically injured after tree branch falls on him in Bengaluru

Four dead in road accident in Kolar

BJP using legislature for ‘politics’ instead of discussing real issues: CM Siddaramaiah

Govt will not remove temples built on Waqf properties, CM Siddaramaiah tells Assembly

MUST WATCH

Latest Additions

Assembly clears Mysuru Development Authority Bill

Blocked 18 OTT platforms for publishing obscene, vulgar content: Govt

Boy critically injured after tree branch falls on him in Bengaluru

Congress claims party worker ‘died due to tear gas smoke’ during protest in Assam

Four dead in road accident in Kolar

Thanks for visiting Udayavani

You seem to have an Ad Blocker on.

To continue reading, please turn it off or whitelist Udayavani.