Global factors, foreign fund trading activity to drive markets this week: Analysts

PTI, Dec 18, 2022, 10:16 AM IST

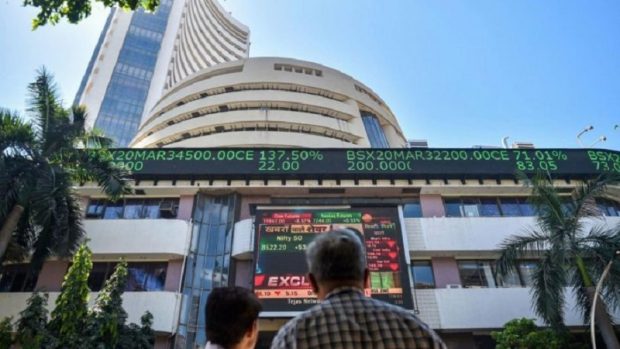

The domestic equity market would focus on global trends and foreign fund trading activity this week amid lack of any major trigger at home, analysts said.

”This week won’t bring any significant cues, so we may see a tussle between bulls and bears. Because the US market is currently experiencing the second wave of selling following the Federal Open Market Committee (FOMC) meeting, its direction will continue to be crucial.

”Due to the fact that FIIs were net sellers for a significant portion of December, institutional flows will be another crucial trigger,” said Santosh Meena, Head of Research, Swastika Investmart Ltd.

Ajit Mishra, VP – Technical Research, Religare Broking Ltd, said, in absence of any major event, cues from global indices, especially the US, would remain on participants’ radar.

Global central banks like the European Central Bank (ECB) and Bank of England (BoE) followed the US Federal Reserve in increasing policy rates and giving hawkish commentary, sending equities tumbling world-wide last week.

Past week, the Sensex declined 843.86 points or 1.36 per cent, while the Nifty shed 227.60 points or 1.23 per cent.

”The Fed startled the market by maintaining its hawkish tone, as investors were expecting a softer approach after the release of better-than-expected inflation numbers. Following the Fed, BoE and ECB raised their interest rate by 50 bps while maintaining their hawkish stance in combating inflation,” said Vinod Nair, Head of Research at Geojit Financial Services.

Lack of major triggers will push the domestic market to follow its global peers this week, Nair added.

”Markets are likely to remain in consolidative range due to lack of triggers in the near-term. Also, lower participation from institutional investors due to upcoming year-end holidays would keep the markets lackluster. Though investors would keep an eye on US home sales and GDP (QoQ) numbers to be released this week,” Siddhartha Khemka, Head – Retail Research, Motilal Oswal Financial Services Ltd, said.

Udayavani is now on Telegram. Click here to join our channel and stay updated with the latest news.

Top News

Related Articles More

Epigamia founder Rohan Mirchandani dies of cardiac arrest at age 42

Lohia Auto launches EV brand ‘Youdha’, aims to sell 3 lakh vehicles by 2027

“FM ji FM ji, itna tax main kaise bharun”, asks investor Vijay Kedia in viral post

RBI: After another status quo year, all eyes on a growth-propping rate cut with new Guv at helm

Front-running case: Sebi bans 9 entities from market , impounds illegal gains of over Rs 21 crore

MUST WATCH

Latest Additions

Kalaburagi: Woman sustains burns after live electric wire falls on her

Nelamangala accident: Police expedite probe, CCTV images being scrutinised

Rohan Estate Mukka – Resort-style luxury layout launched

Minister Parameshwara directs police to ensure tight security in Bengaluru on New Year’s eve

Teachings of Lord Christ celebrate love, harmony: PM Modi at Christmas celebrations

Thanks for visiting Udayavani

You seem to have an Ad Blocker on.

To continue reading, please turn it off or whitelist Udayavani.