IRDAI bans Reliance Health Insurance from selling policies

Team Udayavani, Nov 7, 2019, 6:09 PM IST

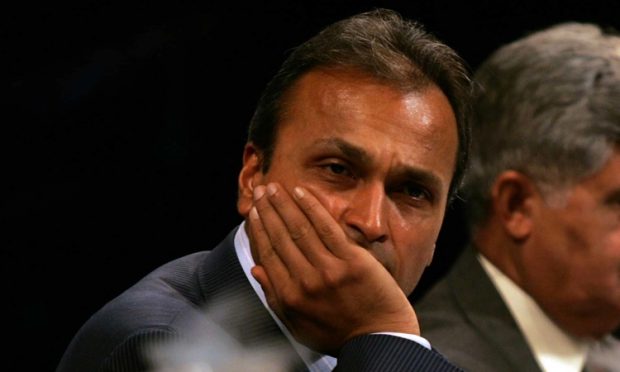

New Delhi: Insurance sector regulator IRDAI has barred Anil Ambani-led Reliance Health Insurance Ltd (RHICL) from selling new policies due to its weak financial health.

The regulator has also asked RHICL to transfer the entire policyholders’ liabilities along with financial assets to Reliance General Insurance Co Ltd (RGICL), which in turn will settle claims of the existing policyholders.

In an order, it said the “solvency of the RHICL is considerably” below the norms and, hence, “continuation of the transaction of health insurance business by RHICL at this junction, will not be in the interest of the policyholders”.

Solvency ratio loosely refers to the financial ability of an insurer to service its obligations, including payment to claims.

“On and from the appointed date (November 15, 2019), RHICL shall stop underwriting insurance business and communication to this effect shall be displayed on the website of RHICL and shall be prominently displayed at all its branches,” said the IRDAI’s order.

IRDAI has also asked RHICL to “ring fence” its residual assets and not dispose them of without the insurance regulator’s prior written approval.

RGICL has been asked to keep the assets and liabilities of RHICL separate from the general insurance business.

“RGICL shall promptly settle claims arising out of RHICL portfolio…,” the order added.

IRDAI had issued a certificate of registration to RHICL to carry out the business of health insurance in October last year.

RHICL had reported a solvency ratio of 106 per cent for the quarter ended June 30. It was below 150 per cent, which is the control level of solvency.

In the backdrop, the IRDAI had asked the insurer to restore the solvency margin to the control level by September 30.

RHICL had said it will submit a “plan to ensure the emergence of a strong, well-capitalised health insurance company”.

However, the response did not indicate the manner in which the control level of solvency would be restored, the Irdai order noted.

RHICL was asked to restore the required level of solvency margin.

“However, despite repeated follow-up, this has not been carried out so far,” Irdai said.

In a release, the IRDAI said it was closely monitoring the situation and has assured RHICL policyholders that their interests “have been adequately protected” and all genuine claims will continue to be duly honoured.

Udayavani is now on Telegram. Click here to join our channel and stay updated with the latest news.

Top News

Related Articles More

Budget Wishlist: Financial sector seeks tax sops, steps to deepen financial markets

India’s manufacturing growth hits 12-month low in Dec amid softer rise in output, new orders

Stock markets start 2025 on high note, snap two-day decline on buying in bluechips

Rs 2000 notes withdrawal: Rs 6,691 cr worth such notes still with public

Petrol, diesel sales soar on holiday travel

MUST WATCH

Latest Additions

Periya twin murder: CBI Court sentences 10 to double life imprisonment

Woman jumps out of moving autorickshaw to save herself from drunk driver

New day, same story: ‘King’ Kohli fails again; India collapse to 185

Bengaluru-Mysuru Infrastructure Corridor Project: Right to property a constitutional right, says SC

BJP stages demonstration against bus fare hike in Karnataka

Thanks for visiting Udayavani

You seem to have an Ad Blocker on.

To continue reading, please turn it off or whitelist Udayavani.