SEBI now looking to tighten FPI disclosure rules it was ‘forced to dilute’ to benefit Adani: Cong

PTI, Jun 1, 2023, 12:17 PM IST

Aday after the SEBI proposed mandating additional disclosure for high-risk Foreign Portfolio Investors, the Congress on Thursday alleged that the regulator was now looking to tighten the very rules it was ”forced to dilute” in 2018 to benefit the Adani Group.

Capital markets regulator Securities and Exchange Board of India (SEBI) on Wednesday came out with a proposal mandating enhanced disclosures from high-risk Foreign Portfolio Investors (FPIs) to guard against possible circumvention of the Minimum Public Shareholding (MPS) requirement.

This came after the SEBI observed that some FPIs have concentrated a substantial portion of their equity portfolio in a single investee company. In some cases, these concentrated holdings have also been near static and maintained for a long time.

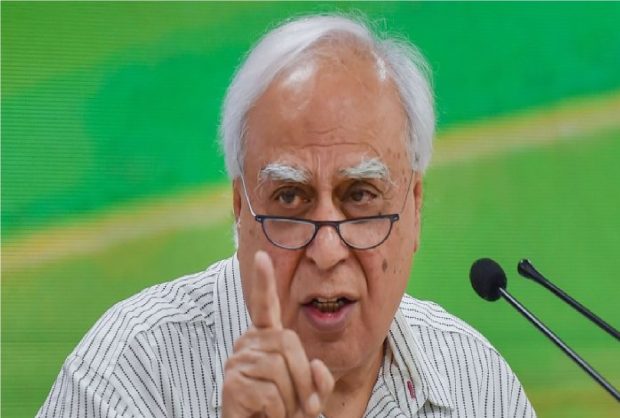

In a tweet, Congress general secretary Jairam Ramesh said, ”The SEBI Consultation Paper put out yesterday proposes to tighten the very rules it was forced to dilute in 2018 to allow foreign portfolio investors to invest in Indian companies without having to reveal their FULL ownership details. This was done to benefit Modani.” ”We hope the Consultation paper is not an eyewash exercise and will cover investments made earlier,” he said.

Ramesh claimed this seems to be a response to the findings of the Supreme Court Expert Committee. ”It also vindicates the Hum Adanike Hain Kaun-HAHK series of 100 questions that we asked of the PM — which he remains totally silent on,” the Congress leader said.

On Wednesday, the SEBI said, ”Such concentrated investments raise concern and possibility that promoters of such corporate groups, or other investors acting in concert, could be using the FPI route for circumventing regulatory requirements such as that of maintaining Minimum Public Shareholding ” In its consultation paper, the regulator has proposed obtaining granular information from high-risk FPIs that have concentrated equity holdings in single companies or business groups.

The Congress has been seeking a joint parliamentary committee probe into the the Adani matter after Hindenburg Research in its January 24 report levelled allegations of fraud, stock manipulation, and money laundering against the Adani group.

While the group has denied all allegations, the Supreme Court constituted an expert committee for assessment of the extant regulatory framework and asked stock market regulator SEBI to complete its probe into allegations.

Udayavani is now on Telegram. Click here to join our channel and stay updated with the latest news.

Top News

Related Articles More

Kharge urges PM Modi to conduct last rites of Manmohan Singh at a place where memorial can be built

DGCA orders suspension of 2 Akasa directors for lapses in pilots training

Ex-PM Manmohan Singh’s funeral at Nigambodh Ghat on Dec 28, says MHA

Punjab: Eight killed, many injured in Bathinda bus accident

Abducted and sold at 8, woman reunites with family after 49 years

MUST WATCH

Latest Additions

Two youths die after bike hits canter while performing stunt wheelies

Karkala: Thief posing as customer steals jewellery, escapes

Shivakumar seeks research centre at Bangalore University for Ex-PM Manmohan Singh

Kharge urges PM Modi to conduct last rites of Manmohan Singh at a place where memorial can be built

Shuttler Lakshya sails into semifinals of King Cup

Thanks for visiting Udayavani

You seem to have an Ad Blocker on.

To continue reading, please turn it off or whitelist Udayavani.