PTI, Dec 15, 2021, 4:58 PM IST

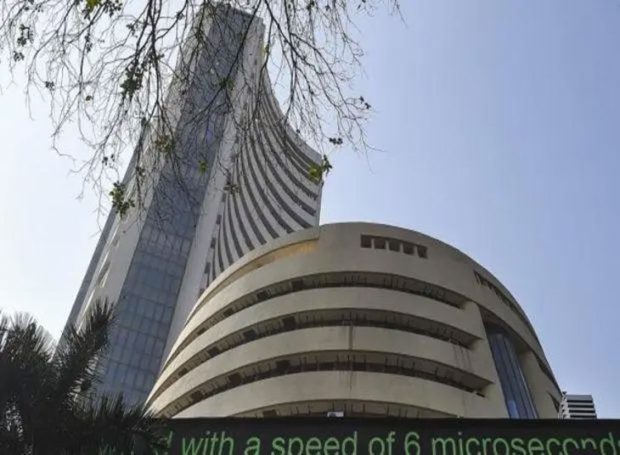

Mumbai: Equity benchmark Sensex dropped 329 points on Wednesday, tracking losses in index majors Infosys, Bajaj Finance and HDFC amid a mixed trend in global markets.

The 30-share index slumped 329.06 points or 0.57 per cent to end 57,788.03. Similarly, the NSE Nifty fell 103.50 points or 0.60 per cent to 17,221.40.

Bajaj Finance was the top loser in the Sensex pack, shedding over 3 per cent, followed by Bajaj Finserv, PowerGrid, ITC and TCS.

On the other hand, Sun Pharma, Kotak Bank, M&M, Maruti and L&T were among the gainers.

According to analysts, weak global cues and continued foreign fund outflow are weighing on market sentiment.

Elsewhere in Asia, bourses in Shanghai and Hong Kong ended with losses, while Tokyo and Seoul were positive.

Stock exchanges in Europe were also trading on a mixed note in mid-session deals.

Meanwhile, international oil benchmark Brent crude fell 0.90 per cent to USD 73.04 per barrel.

Udayavani is now on Telegram. Click here to join our channel and stay updated with the latest news.

Reliance Consumer Products Limited Acquires Velvette

Gold zooms past record Rs 89k-mark, silver rallies Rs 2,000 to 4-month high

Wholesale price inflation eases to 2.31pc in Jan

Karnataka signs MoUs worth Rs 2,220 cr on day two of GIM 2025

Celebrating Valentine’s Day: Airlines come up with rate discount, special menu

PM didn’t tell his good friend about country’s outrage over handcuffing Indian deportees: Congress

Maha Kumbh: Akhilesh seeks compensation to kin of devotees killed in accidents

“Namma Sante” buzz: From coconut shell art to pure honey delights!

K’taka irrigation issues: CM urges Deve Gowda to come forward to protect state’s interest

Two held in Rs 850 crore ponzi scheme case: Cyberabad Police

You seem to have an Ad Blocker on.

To continue reading, please turn it off or whitelist Udayavani.